Unfit dishonour fees are weighing down gyms

Payments and banking are modernising at a rapid rate, but are, in some respects, being held back by old-fashioned concepts and practices. This includes fee structures and processes that should have been left in the 20th century.

Failed payment fees that are commonly thrust upon gyms are wrongheaded and often used in ways that are deeply anti-consumer and anti-business. Failure should not be a revenue stream.

One Big Misconception

But why have failed payment fees – or dishonour fees – stuck around for so long?

At GoCardless, we often hear from consumers the misconception that it’s gyms themselves that enforce these fees, but that’s rarely the case.

For instance, if you manage a gym and your customers pay a fee late or try to cancel a membership prematurely, do they get squeezed with punitive charges outside of your control?

Gyms are one of the industries most criticised for this behaviour, but as you know, it’s actually the payment providers who design and implement these fee structures for their own benefit.

Gyms play an important role in the lives of Australians. In 2023, Australians spent around $3.5 billion on fitness clubs and gyms, with about 1 in 5 having a membership. These facilities are key to helping people lead healthier lives, so it’s essential for gyms to build strong connections within their networks - especially as many members are facing rising living costs.

Luckily, there are alternative payment providers that can offer more reasonable systems that ease this burden, and gyms can stoke demand for better systems and fairer consumer conditions by making the switch.

The Issue with Dishonour Fees

Here’s the big picture, though: in good economic conditions or bad, punishing people who are already struggling financially is fundamentally wrong.

Dishonour fees are not only outdated but also predatory - and there’s no reason for them to exist besides driving profits.

Unlike other electronic payment processes such as chargebacks, failed payments simply do not incur significant costs that would justify hitting the consumer with more bills.

To add to this, whatever nominal cost may be associated with processing a failed payment stands in stark contrast to the excessive dishonour fees charged by some payment providers.

For example, some providers charge as much as $25 for a failed payment and may attempt to debit the account multiple times. This can result in total fees that are several times the original transaction amount.

This practice not only punishes customers but also damages the relationship between gyms and their clients – and often, the gyms don’t even realise this is happening!

So what’s the fix?

Quite simply, if there are no dishonour fees, you force the payment provider to invest in providing value to the business instead - namely, through ensuring their payments are successful. Without dishonour fees, the payment provider and gym have their incentives aligned.

The way forward is all about using fairer and smarter payment solutions. Platforms that can pinpoint the best days to charge customers – ie. when payment success is at its peak for gyms - can make it easier to ensure payments go through when funds are likely to be available.

For gyms that use our platform, the first, fifth and eighth days of the month are often days with the highest rate of successful payments.

At the same time, we see that the 25th and 10th have the highest rate of payment failures for our gym customers. By using technology to better time their payments, gyms can cut down on failed transactions, ease the financial pressure on their members, and avoid passing on extra costs.

The demand is there, too. According to our Pursuing Payments report, 62% of Australian business owners and key decision-makers are interested in introducing tech to their businesses that could help reduce the rate of failed payments. Many of these businesses may not even be aware that fairer approaches to chasing payments are accessible to them, or understand the true impact dishonour fees are having on their customers.

Pairing this with broader adoption of PayTo technology would be highly effective. PayTo is an innovative service enabling instant payments directly from customer’s bank accounts, with real-time account verification to ensure funds are available - reducing failed payments. If the Australian Government considers capping or banning dishonour fees, incentivising businesses to adopt PayTo could be a smart move.

Our payment ecosystem needs to keep pace with modern consumer expectations. Outdated fees, especially dishonour fees, hold back smaller gyms and burden members.

Adopting fair, tech-driven payment practices can support gyms and their communities when they need it most. The future of payments is all about innovation, fairness, and support—it’s time for providers to lead the charge toward more equitable fees in fitness.

Access Go Cardless Pursuing Payments report

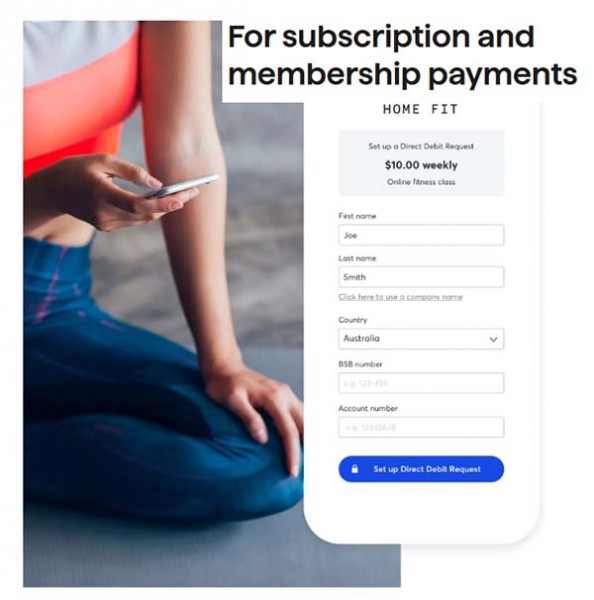

Image. Credit: Go Cardless

Related Articles

5th December 2024 - GoXPro Digitalised Challenges rolls out at Fitness First and Celebrity Fitness across Southeast Asia

27th November 2024 - Ezypay and Exerp announce strategic partnership

4th November 2024 - Wellington Shire Council introduces $15 a week access to 24/7 gym

11th July 2024 - Gymdesk secures $32.5 million to expand its fitness software platform

11th June 2024 - Jetts Fitness and ABC Fitness partner for Membership Management solutions

22nd May 2024 - Viva Leisure advises of completion of Viva Pay across the Plus Fitness network

28th February 2024 - EGYM and Virtuagym partnership delivers integration of club management software

27th January 2024 - No fair trading or consumer affairs warnings over fitness memberships during ‘gym-uary’

19th December 2023 - Survey reveals fees charged by Western Australian aquatic, recreation and sport centres

30th November 2023 - Clubworx App offers potential to transform fitness businesses

15th February 2023 - Ezypay expands subscription payment capabilities to South Korea

22nd June 2022 - The importance of high-tech, low-touch payments

17th September 2015 - AuSAE announces new billing partnership with PaySmart

11th November 2009 - Direct debiting aids fitness businesses’ cashflow

Support our industry news service

We hope that you value the news that we publish so while you're here can we ask for your support?

As an independent publisher, we need reader support for our industry news gathering so ask that - if you don't already do so - you back us by subscribing to the printed Australasian Leisure Management magazine and/or our online news.

Click here to view our subscription options.

supplier directory

The Complete Guide to Leisure Industry Products & Services.

PlayRope

Playrope Aqua-Fun, are the Australian & New Zealand exclusive distributors for Vortex Aquatic Structures International, the world leader in aquatic playgrounds and urban water landscapes.…

read moreElite Pool Covers

Since 1989 Elite Pool Covers have designed and manufactured an extensive range of high quality affordable manual,semi-automatic and fully-automatic pool cover systems for the harsh Australian…

read moreAflex Inflatables

Aflex Inflatables are the leaders for obstacle courses, pool toys, waterparks and land-based watersides and fitness runs. They are industry leaders offering the widest range of pool, lake and beach…

read moreHydrocare Pool Services

Hydrocare Pool Services Pty Ltd offer 30 years of experience in aquatic industry features, products and water treatment. Hydrocare Pools has undertaken water treatment for aquatic centres and…

read morePaySmart

Headquartered in Brisbane with an Australia-wide network of satellite offices, PaySmart is one of Australia’s largest and longest-standing direct debit billing companies. In 1996 we began…

read moreLinks Modular Solutions

Links Modular Solutions was a leading provider of high-quality, innovative software solutions for aquatic and recreation facilities. Links Modular Solutions is now part of Xplor Technologies.

read moreAAC

Welcome to AAC – makers of the world’s best wristbands, lanyards, tickets, tokens and full-service print solutions. We are Australia’s premier global manufacturer and supplier of…

read moreget listed with our suppliers directory

Get your business noticed in our targeted directory. Viewed by 10,000 industry professionals per week!